Best Credit Counselling Singapore: Secure Your Financial Future Today

Best Credit Counselling Singapore: Secure Your Financial Future Today

Blog Article

Recognizing Credit Report Counselling: Exactly How Professional Support Can Assist You Take Care Of Debt Properly

Credit score coaching offers as an essential source for people grappling with financial obligation, using customized strategies made to address their particular economic obstacles. The subtleties of exactly how credit history therapy operates and the criteria for selecting the right counsellor frequently continue to be vague.

What Is Credit Coaching?

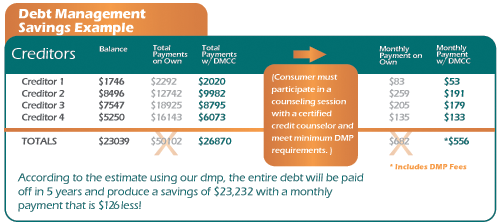

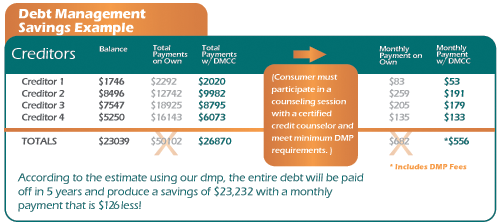

During the coaching sessions, customers are motivated to review their financial difficulties openly, enabling the counsellor to assess their economic health comprehensively. This assessment usually leads to the development of an organized plan that lays out steps for decreasing financial obligation, boosting financial savings, and attaining long-lasting economic stability. Debt counsellors may additionally help with interaction with financial institutions, helping clients negotiate more positive payment terms or debt settlements.

Credit report therapy stands out from financial debt negotiation or insolvency solutions, concentrating rather on empowering individuals with the understanding and tools needed to regain control over their finances. By fostering financial literacy, credit score coaching not just addresses prompt financial debt concerns but also gears up clients with abilities to make enlightened economic choices in the future.

Advantages of Credit History Therapy

Among the crucial benefits of credit scores counselling is its capacity to give people with tailored approaches for managing their financial obstacles. By examining a person's one-of-a-kind economic circumstance, credit counsellors can create individualized plans that deal with specific financial debts, income levels, and investing practices. This customized method helps clients obtain a clearer understanding of their economic landscape.

Additionally, credit history coaching frequently results in boosted financial proficiency. Clients get education on budgeting, saving, and liable debt use, which encourages them to make informed choices in the future. credit counselling services with EDUdebt. This expertise can promote lasting financial stability and self-confidence

Credit history counselling can also facilitate arrangements with creditors, potentially resulting in decreased rate of interest or more manageable layaway plan. This can alleviate the instant stress and anxiety connected with overwhelming financial obligation and offer a clearer course towards economic recovery.

How Credit History Coaching Functions

The process of credit history counselling generally begins with an initial analysis of a client's monetary circumstance, which includes a comprehensive review of their income, expenditures, financial debts, and credit report. This fundamental action enables the credit rating counsellor to recognize the client's unique financial landscape and recognize areas requiring enhancement.

Adhering to the assessment, the debt counsellor collaborates with the client to establish a tailored activity plan. This plan might include budgeting techniques, debt monitoring methods, and recommendations for boosting credit rating. The counsellor might likewise negotiate with lenders in behalf of the customer to establish extra positive payment terms or lower interest rates.

Throughout the therapy procedure, clients are informed on economic literacy, furnishing them with the expertise required to make educated choices progressing. Regular follow-up sessions are important, making sure the customer remains on track with their financial objectives and can adjust the plan as conditions check out this site alter.

Eventually, credit rating coaching intends to empower customers, aiding them regain control of their finances and leading the method for an extra safe financial future. By offering professional guidance, credit counsellors play an essential function in helping with efficient financial obligation monitoring.

Choosing the Right Credit Counsellor

Choosing a proper credit score counsellor is a significant action in the journey toward monetary security - credit counselling services with EDUdebt. The ideal counsellor can provide tailored guidance and support, assisting you navigate complicated economic scenarios effectively. To start, research study qualifications and accreditations. Try to find counsellors affiliated with respectable companies such as the National Foundation for Debt Counseling (NFCC) or the Financial Therapy Organization of America (FCAA), as these associations usually show a dedication to ethical standards.

Following, take into consideration the counsellor's experience and competence in taking care of your particular monetary problems. Schedule examinations to gauge their strategy and communication design; efficient debt coaching ought to cultivate a sense of count on and understanding. Throughout these meetings, make inquiries about their charges and repayment structures to make sure transparency and to avoid unanticipated expenses.

In addition, seek reviews and endorsements from previous clients to examine the counsellor's performance and approachability. Ultimately, ensure that the counsellor uses a thorough variety of solutions, consisting of budgeting assistance, financial obligation monitoring plans, and economic education resources. By meticulously examining these factors, you can select a debt counsellor who straightens with your financial requirements and goals, leading the way for a more protected economic future.

Success Stories and Reviews

Several individuals have found restored hope and security via their experiences with credit report coaching. Testimonials from clients typically highlight transformative trips where frustrating debt was replaced with financial clarity and confidence. As an example, one customer shared just how a credit rating counsellor assisted them create a tailored spending plan, significantly decreasing their monthly expenses and permitting them to allocate funds towards paying off debts. This recommended you read critical approach empowered them to regain control over their economic scenario.

Another success tale involves a family members that sought credit rating coaching after dealing with unexpected clinical costs. With professional support, they were able to discuss with creditors, leading to reduced rates of interest and workable layaway plan. The family shared gratitude for not only relieving their economic worry yet likewise bring back consistency within their household.

In addition, many clients report improved credit history as a straight outcome of sticking to the methods provided by their debt counsellors. These real-life examples highlight the profound effect that expert guidance can have on people fighting with debt (credit counselling services with EDUdebt). As they navigate their economic trips, these success tales act as a testament to the effectiveness of credit report coaching in fostering long-lasting economic wellness and strength

Conclusion

By giving customized financial advice and education, certified credit counsellors encourage clients to develop reliable financial obligation management strategies. The benefits of credit scores coaching prolong beyond prompt alleviation, fostering long-term economic security and proficiency.

Debt counselling is an economic service created to aid people in managing their financial debts and improving their total monetary proficiency. The primary goal of credit scores coaching is to educate clients on different monetary ideas, consisting of budgeting, financial debt management, and the effects of credit score scores.

By thoroughly reviewing these elements, you can pick a credit history counsellor that lines up with your financial requirements and objectives, leading the next method for an extra secure financial future.

Furthermore, several clients report improved credit score ratings as a direct result of adhering to the techniques offered by their credit rating counsellors. As they navigate their financial journeys, these success tales offer as a testimony to the performance of credit scores counselling in promoting long-lasting financial health and resilience.

Report this page